Our Impact

Small businesses are the driver and the heart of a thriving economy. Smallholder farmers supply a third of the world’s food, and local businesses create meaningful job opportunities that deepen a community and curb emigration.

Despite their importance and potential, many small businesses are unable to access capital, lines of credit, or loans from traditional banks. They need investment, structured with an understanding of how they operate and where their risks and potential lie.

Access to adequate funding allows these businesses to invest in technology, expand their operations, and improve their products and services. With the right financial support, small businesses can compete on a larger scale, enter new markets, and innovate more effectively. This not only benefits the businesses themselves but also creates a ripple effect, driving innovation and competition within industries and ultimately benefiting consumers through better products and services.

Small businesses also require technical support to ensure that they can expand operations intelligently, improve their products and services, and compete on a larger scale. Ultimately, when a small business succeeds, it creates a ripple effect, driving innovation and competition within industries and benefiting consumers through better products and services.

It goes beyond economies.

Across the board, supporting small businesses promotes social equity and inclusion. Many small enterprises are owned by women, minorities, and marginalised communities, who often face significant barriers to accessing traditional financing. By providing these businesses with the necessary capital and resources, we help level the playing field and ensure that everyone can succeed. This inclusivity strengthens communities, fosters diversity, and builds a more just and equitable global economy at a larger scale.

Localised and Tailored Support

In Guatemala, our Creating Economic Opportunities (CEO) project is directly addressing the lack of jobs across the country by investing in small and medium-sized businesses and engaging with the private sector to upgrade infrastructure. Supporting local organisations like this gives more people the opportunity to build a life for themselves and their families in their own community.

In Totonicapan, Guatemala, 29-year-old Selvin Tobar lives with his wife and five-year-old daughter in his in-law’s house in Salcajá. He works full-time at a used clothing store making about $500/month and has dreamed of having his own home for his family. While he was given land behind his parents’ home, it wasn’t sufficient collateral to borrow money to build a house.

Selvin is a member of COSAMI, the largest savings and credit cooperative in Guatemala, with more than 223,000 members in six departments in the Western Highlands and southern coast. In the last few years, the Co-op has seen an increase in requests to finance home-building, so they partnered with USAID to implement a pilot project.

The key change was developing a new way of calculating what they could lend to members based on the future value of a built or renovated house. To ensure that this did not incur any additional risk for the Co-op or its members, the pilot project created an in-house team of experts and built relationships with 12 construction firms that do the work in different departments. The new Decent Housing Unit has seven staff, including financing agents trained to analyse land titles and family income as an initial step to developing a housing project or renovation, three architects, and three engineers to review the proposed site for its size and suitability for construction, remodelling, or expansion as appropriate.

The program has been a huge success for COSAMI and for local families: 310 families borrowed $8.4 million to build new homes or renovate existing ones. These projects generated 775 construction jobs in communities in Quetzaltenango, Quiché, and Totonicapán – and have guaranteed homes for families like Selvin’s, who now have a two-level home with space for the future. Pilot programs like COSAMI’s are playing a critical role in helping families stay in Guatemala, decreasing migration out of the country, while USAID’s support is helping to ensure local businesses and institutions can continue supporting those in communities that need the help the most.

Economic Empowerment

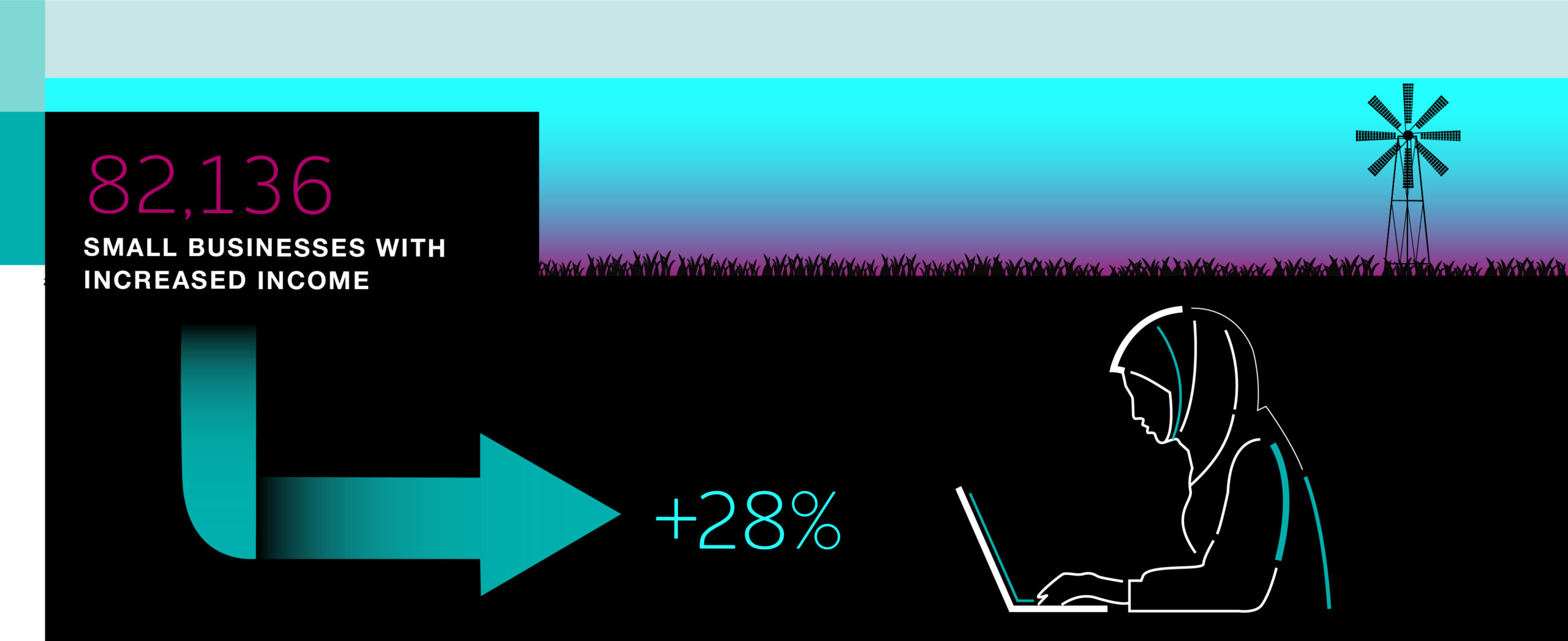

CATALYZE, which works across 27 countries to mobilise $2 billion in private capital for development impact, especially in underserved social sectors and frontier markets across the globe, assisted 55,008 small businesses in 2023, out of which 35,833 were women-owned and 778 were schools. By working with local and international businesses and investors to explore and find commercially viable opportunities and approaches to creating jobs, the team is helping to advance inclusive growth and improve lives.

One such small business was in Burkina Faso, in the Centre Nord region. Violent extremist attacks, growing food price inflation, climate change, and the residual effects of the COVID-19 pandemic hit the region particularly hard, resulting in hardships for the local population and the 494,000 internally displaced persons who now reside there.

For Aminata Ouedraogo, a young entrepreneur who runs a micro-enterprise with a diverse set of activities (including selling wheat bran and other types of animal feed, processing peanuts to create peanut oil, and a type of flour known locally as “koura-koura”), gaining access to capital was critical for her survival. But in 2021, her business collapsed following an armed attack that destroyed goods and cost Ouedraogo a large part of her working capital. The displacement of several customers from the surrounding villages compounded Ouedraogo’s cash flow challenges as they would previously buy koura-koura on credit and repay her during the Kaya market.

To get her business back on track, Ouedraogo contacted several microfinance institutions to obtain a loan. Unfortunately, as with millions of women in Burkina Faso’s rural areas, Ouedraogo’s access to adequate and timely financial services is limited or non-existent. The loans she was offered consistently fell short of covering the cost of 5 tonnes of wheat needed to kickstart her business’ recovery.

Thanks to the support of USAID CATALYZE Finance for Resilience partner financial institution GRAINE SARL, Ouedraogo received a loan to kickstart her business’ recovery. Greater economic power has enabled Ouedraogo to become more autonomous and improve her family’s food security situation. She continues to work with GRAINE SARL, saving part of her income to build a peanut processing facility.

Ouedraogo’s success is also impacting her community and reducing unemployment in her village. Her enterprise has grown from six to 10 permanent workers and from 50 to 60 temporary workers.